World - Tyres For Motor Cars - Market Analysis, Forecast, Size, Trends and Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingCar Tyre Market - Should Domestic Industry Benefit From China Tail Off?

Photo: © kadmy / Bigstockphoto

In 2014, a restrictive tax duty was introduced in the USA, with regard to the import of car tyres from the People's Republic of China (PRC). As a result, the share of Chinese-manufactured car tyres on the American market has fallen from X% to X%. This decline, has, in turn, led to a drop in car tyre output in China, recorded initially as of 2008: the drop in USA imports was not offset by increased exports to other countries. At the same time, American manufacturers could only partly satisfy the newly-nascent market niche. Car tyre manufacturers elsewhere in Asia have taken advantage of the reduced presence of Chinese companies in the USA; this accounts for the relatively insignificant growth in USA car tyre output, against the increase in Asian exports. The restrictive tax duty may have an adverse impact on the position of American car tyre producers operating not only in the PRC, but also enhance competition worldwide, as Chinese companies could diversify their supplies to new markets.

Based on the past year's results, Chinese car tyre exports to the USA market experienced more than a twofold contraction, to $X million. According to IndexBox, the share of Chinese car tyres in terms of USA total consumption also declined: once standing at X% in value terms in 2014, this figure fell to X% in 2015. The impact of the anti-dumping tax duties, introduced by the USA the previous year to shield American manufacturers against competition from cheaper Chinese imports, is a key factor behind this change.

However, car tyre products from across Asia (particuarly South Korea, Thailand and Indonesia) and Mexico have replaced their Chinese counterparts. Manufacturers in these countries have succeeded in increasing exports to the USA faster than USA-based producers have been able to expand their presence on the domestic market. Lower labour costs than in the USA, combined with the favourable foreign exchange rate against the US dollar, have made it feasible for Asian manufacturers to achieve this.

In an effort to retain the large American market, Chinese car tyre manufacturers have moved with an initiative to counter the restrictive tax duty. China has argued that Chinese-produced car tyres were mainly used for repair and replacement purposes, as opposed to their American alternatives, which are mainly despatched to the car plants for the initial installation process.

However, the Chinese have failed to achieve a complete waiver of the tax duty. As history shows, this tax levy may only be a temporary measure. On several occasions, the U.S. adopted measures to protect the domestic market. In 2010, high tariffs were introduced on car tyre imports from the PRC, resulting in a X% drop in Chinese car tyre exports to the USA. Several years later these tariffs were removed, and China regained their previous position on the American market. The adoption of more stringent technical standards, in conjunction with the EU, on car tyre imports, was yet another of these measures, which resulted in Chinese manufacturers being lumbered with higher costs.

For a long time now, China has been the world's largest manufacturer on the car tyre market: in value terms, China produces about one third of the global car tyre output, while the USA is in second place, with only X% of global production. Relatively low labour costs and the fact that the world's leading tyre manufacturers have their own production bases in the PRC, account for China's leading position. Low prices for basic raw materials, namely natural rubber, and the availability of other materials, such as synthetic rubber, carbon black and zinc oxide also contribute to China's dominance.

As a result of increased output, China aggressively began to step up car tyre exports. Chinese-produced car tyres proved to be more competitive than their global counterparts, due to the fact that they were cheaper. From 2007-2014, Chinese car tyre exports increased almost twofold in value terms, to $X billion. At this time, the USA was the main market for the Chinese product; by 2014 year-end in the USA, X% of total car tyre imports originated from China.

Last year, however, with stringent trade barriers in place, China was forced to cut back on car tyre output for the first time since 2008. China failed to offset the partial loss of the American market by increasing exports to other destinations. One factor for this was the continuing downward trend in the global economy, which in turn, led to a slow in demand for car tyres. The tightening of technical standards for manufacturers intending to export car tyres to the USA and the EU, also proved to be a further negative factor. It is worth noting, that the position of Chinese companies could deteriorate further in the immediate term, due to the possible introduction of tax duties by a number of major consumer countries, the EU included, on car tyres from the PRC.

In terms of the USA car tyre industry, its position has seen a tangible improvement following the introduction of the restrictive tax duty: According to IndexBox, its share within the structure of car tyre consumption has increased by X percentage points overall (from X% to X%), while the share of imports still accounts for over X%. Chinese imports, therefore, have effectively been replaced by imports from other countries.

In the USA, key factors currently affecting car tyre demand included the state of the economy and the conditions on the car market. The American car industry experienced a painful recession during the 2008 crisis, but the sector has recovered to pre-crisis levels of development in the past few years. Weak growth was recorded last year, due to the expanding demand for cars, and greater access to car loans, combined with low interest rates. The recovery of the American economy, increased employment and rising household incomes, set against low petrol prices will promote the development of car and vehicle use. This, in turn, will increase the intensity of car tyre use, which (along with product quality, and the road and weather conditions) will be an important factor in the sale of new tyres, implying that car tyres will need to be changed and replaced on a more frequent basis, thereby resulting in a surge in demand.

Overall, the introduction of restrictive import duties on car tyres from China has been equivocal. The nascent market niche was composed of not so much increased car tyre output by American manufacturers, as a surge in car tyre imports from across Asia. At the same time, this could damage the stability of American car tyre manufacturers operating in the PRC, and which account for two thirds of Chinese car tyre exports. In addition, losses incurred from the key market will encourage Chinese manufacturers to actively enter other markets, increasing competition for American producer-companies and their divisions world-wide.

Do you want to know more about the global car tyre market? Get the latest trends and insight from our report. It includes a wide range of statistics on

- car tyre market share

- car tyre prices

- car tyre industry

- car tyre sales

- car tyre market forecast

- car tyre price forecast

- key car tyre producers

Source: World: Tyres For Motor Cars - Market Report. Analysis and Forecast to 2020

Join Us at HANNOVER MESSE 2024

Don’t miss your chance to connect with us directly. Schedule a personal meeting to dive deeper into how solutions.

Hall 002, Stand C10. 22 - 26 April 2024 | Hannover, Germany

This report provides an in-depth analysis of the global passenger car tyre market. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- Prodcom 22111100 - New pneumatic rubber tyres for motor cars (including for racing cars)

Country coverage:

Worldwide - the report contains statistical data for 200 countries and includes detailed profiles of the 50 largest consuming countries:

- USA

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

+ the largest producing countries

Data coverage:

- Global market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Global production, split by region and country

- Global trade (exports and imports)

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

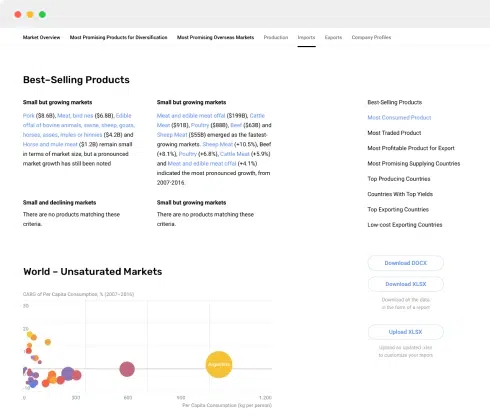

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

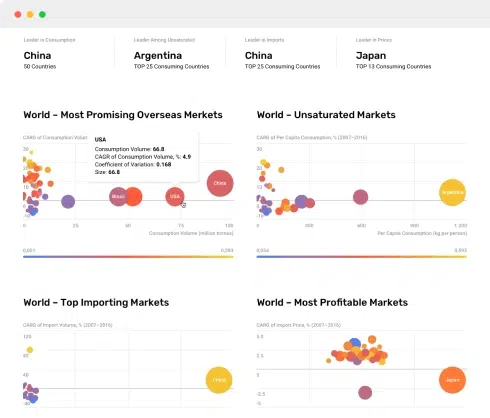

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. GLOBAL PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

8. GLOBAL IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. GLOBAL EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- United States

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

-

LIST OF TABLES

- Key Findings In 2023

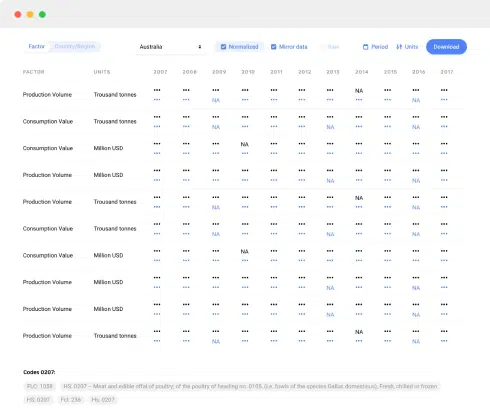

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023