World - Anhydrous Ammonia - Market Analysis, Forecast, Size, Trends And Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingThe Low-Carbon Agenda and the Rising Demand for Innovative Fuels to Drive the Global Ammonia Market

IndexBox has just published a new report: 'World - Anhydrous Ammonia - Market Analysis, Forecast, Size, Trends, and Insights'. Here is a summary of the report's key findings.

Ammonia constitutes one of the world's basic chemical products widely important for its use as a raw material for the production of mineral fertilizers, nitric acid, explosives, and polymers. Agricultural fertilizers account for near 80% of the world's ammonia use.

Due to the continuous growth of the world's population and a stable increase in world GDP, the need for crop-based foods and animal feed is rising, which is a key fundamental factor in the growth of demand for ammonia.

The global ammonia market stood at $90.7B, according to IndexBox estimates. Global consumption peaked at $100.7B in 2013; however, from 2014 to 2019, consumption remained at a lower figure. In physical terms, global ammonia consumption was estimated at approximately 182M tons in 2019, declining slightly against the previous year.

In early 2020, the global economy entered a period of the crisis caused by the outbreak of the COVID-19 pandemic. The quarantine measures that put on halt production and transport activity disrupted economic growth heavily throughout the world. According to World Bank forecasts, despite the gradual relaxing of restrictive measures and unprecedented government support in countries that faced the pandemic in early 2020, the annual decline of global GDP could amount to -4.3%, which is the deepest global recession being seen over the past eight decades.

However, the ammonia market remains relatively resilient to the pandemic. In the second quarter of 2020, there was a slight drop in demand from mineral fertilizer producers due to the introduced isolation regime and a shortage of labor, many regions missed handling the spring sowing season. After the lifting of restrictive measures, the demand for ammonia recovered, and companies adapted to new conditions of supply chains and sales channels.

China (48M tons) remains the largest ammonia-consuming country worldwide, accounting for 27% of the total volume. Moreover, ammonia consumption in China exceeded the figures recorded by the second-largest consumer, the U.S. (21M tons), twofold. India (19M tons) ranked third in terms of total consumption with a 10% share.

In China, ammonia consumption contracted by an average annual rate of -2.4% over the period from 2012-2019. The remaining consuming countries recorded the following average annual rates of consumption growth: the U.S. (+2.7% per year) and India (+2.6% per year).

In value terms, China ($33.4B) led the market, alone. The second position in the ranking was occupied by India ($12.1B). It was followed by the U.S.

With the pandemic's impact, it is expected that in 2020, global consumption of ammonia should remain nearly unchanged against 2019. In the medium term, as the global economy gets back to work, the market will start recovering, driven by major fundamentals that existed before the crisis. Overall, market performance is forecast to pursue a positive trend over the next decade, expanding with an anticipated CAGR of +0.4% for the period from 2019 to 2030, which is projected to bring the market volume to 191 M tons by the end of 2030 (IndexBox estimates).

New areas of industrial use of ammonia are emerging, which are becoming increasingly relevant in the context of increased attention to environmental protection and reduction of greenhouse gas emissions. Standard industrial synthesis of ammonia from nitrogen and hydrogen from methane produces more carbon dioxide than many other chemical industries. The largest producers are developing the production of "green ammonia" and positioning it as a more environmentally friendly product in comparison with conventional ammonia.

Another promising opportunity for the use of ammonia is its use as a carbon-free fuel. Compared to hydrogen, ammonia has the advantage of being easier to transport and store because a large amount of energy could be stored in smaller volumes of a substance.

Given this background, Japan is considering replacing coal fuel for power plants with ammonia, and it is also emerging as a marine fuel. Ammonia as an energy source complies with the new IMO 2020 requirements that limit the sulfur content in bunker fuel and will reduce CO2 emissions to target environmental indicators.

Increased attention to the regulation of carbon emissions in the EU and large-scale measures under the Green Deal action plan, as well as the return of the United States to the Paris Climate Agreement, should contribute to the search for alternative fuels, including ammonia, and transforming energy markets. If promising technologies of ammonia fuel become widespread in the industry, the growth of production of low-carbon fuel may become a new driver of the world ammonia market in the medium and long term.

The changes in the ‘green' legislation could potentially lead to market transformations in the energy sector. In connection with the announcement by the European Union of plans to introduce a cross-border carbon tax, many countries that do not produce "green" ammonia may lose their positions in the European sales market. In the medium term, this situation will force producers to restructure their processes towards obtaining "green" ammonia and may lead to significant shifts in the structure of the global ammonia value chain.

Join Us at HANNOVER MESSE 2024

Don’t miss your chance to connect with us directly. Schedule a personal meeting to dive deeper into how solutions.

Hall 002, Stand C10. 22 - 26 April 2024 | Hannover, Germany

This report provides an in-depth analysis of the global ammonia market. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

- Prodcom 20151075 - Anhydrous ammonia

Country coverage:

Worldwide - the report contains statistical data for 200 countries and includes detailed profiles of the 50 largest consuming countries:

- USA

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

+ the largest producing countries

Data coverage:

- Global market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Global production, split by region and country

- Global trade (exports and imports)

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Company coverage:

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

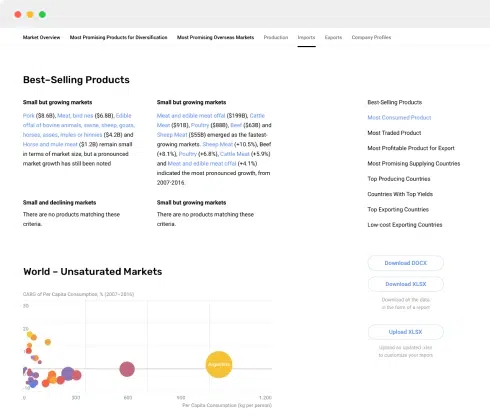

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

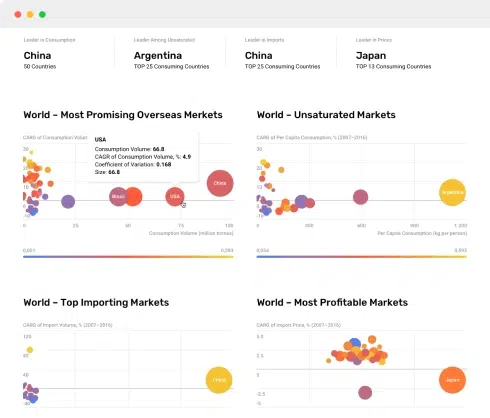

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. GLOBAL PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

8. GLOBAL IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. GLOBAL EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- United States

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

-

LIST OF TABLES

- Key Findings In 2023

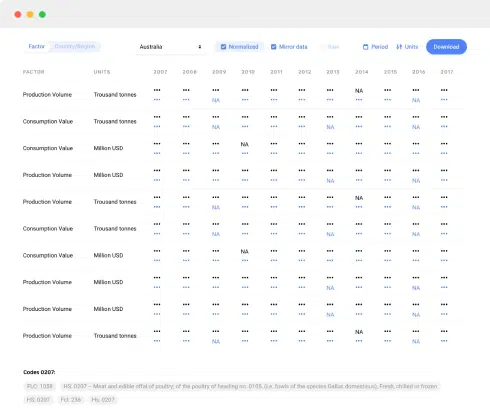

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023