World - Crude Oil and Processed Petroleum - Market Analysis, Forecast, Size, Trends And Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingCrude Oil Trading Price

Crude Oil Trading Price

Crude oil trading price refers to the value at which crude oil is bought and sold in financial markets. The price of crude oil is influenced by various factors including supply and demand dynamics, geopolitical events, economic indicators, and market speculation. As a highly sought-after commodity, crude oil is traded in significant volumes worldwide.

Factors Affecting Crude Oil Prices

1. Supply and Demand: The basic principles of supply and demand play a major role in determining crude oil prices. If the demand for oil exceeds the available supply, prices tend to rise, and vice versa. Factors influencing supply include geopolitical tensions, production quotas by oil-producing nations, and natural disasters. Demand factors include economic growth, consumption patterns, and geopolitical stability.

2. OPEC Policies: The Organization of the Petroleum Exporting Countries (OPEC) is a major influencer of crude oil prices. OPEC member countries control a significant portion of global oil production and have the ability to manipulate prices through their production levels and export policies. Decisions taken by OPEC regarding production cuts or increases often have a direct impact on crude oil prices.

3. Geopolitical Events: Political and military conflicts in oil-producing regions can disrupt oil supplies and push prices higher. This includes events such as wars, sanctions, and regime changes, as well as unrest in major oil-producing nations.

4. Economic Indicators: Economic indicators, such as gross domestic product (GDP) growth, inflation rates, and unemployment levels, can affect crude oil prices. Strong economic growth typically leads to increased oil consumption and higher prices, while economic downturns may result in reduced demand and lower prices.

5. Market Speculation: Speculators, including hedge funds and investment banks, often engage in trading crude oil futures contracts as a way to profit from price fluctuations. Their activities can contribute to short-term volatility in crude oil prices, especially when driven by sentiment and market rumors.

Crude Oil Trading Markets

Crude oil is primarily traded on two major exchanges: the New York Mercantile Exchange (NYMEX) in the United States and the Intercontinental Exchange (ICE) in Europe.

NYMEX, now a part of the Chicago Mercantile Exchange (CME) Group, trades crude oil futures contracts known as West Texas Intermediate (WTI). This benchmark represents light, sweet crude oil sourced mainly from the United States. Contracts are standardized in terms of quantity, quality, and delivery location.

ICE trades Brent crude oil futures contracts, which represent a blend of crude oils extracted from fields in the North Sea. Brent crude is considered a global benchmark for pricing and is widely used for physical oil trading. Similar to NYMEX, ICE also offers contracts with standardized specifications.

Impact of Crude Oil Prices

Changes in crude oil prices can have significant implications for various stakeholders:

1. Consumers: Crude oil price increases can lead to higher fuel costs for transportation and heating, impacting household budgets. This can also result in higher prices for goods and services, as transportation costs are passed on to consumers.

2. Producers: Higher crude oil prices benefit oil-producing countries and companies as they generate increased revenue. However, sustained low prices can negatively affect their profitability and economic stability.

3. Investors: Crude oil prices can create opportunities for investors, including those who trade commodities futures contracts or invest in energy-related stocks and exchange-traded funds (ETFs).

4. Global Economy: As one of the most traded commodities in the world, crude oil prices can have a significant impact on the global economy. Fluctuations in oil prices can influence inflation rates, currency exchange rates, and the overall health of economies, especially for oil-importing nations.

Conclusion

Crude oil trading prices are influenced by a multitude of factors, including supply and demand dynamics, geopolitical events, economic indicators, and market speculation. Understanding these factors is crucial for traders, investors, and policymakers in analyzing and predicting crude oil price movements. The impact of crude oil prices extends beyond financial markets and has implications for consumers, producers, and the global economy as a whole.

This report provides an in-depth analysis of the global market for crude oil and processed petroleum. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

Country coverage:

Worldwide - the report contains statistical data for 200 countries and includes detailed profiles of the 50 largest consuming countries:

- USA

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

+ the largest producing countries

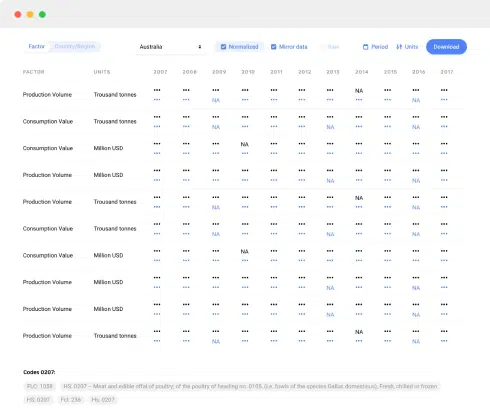

Data coverage:

- Global market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Global production, split by region and country

- Global trade (exports and imports)

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

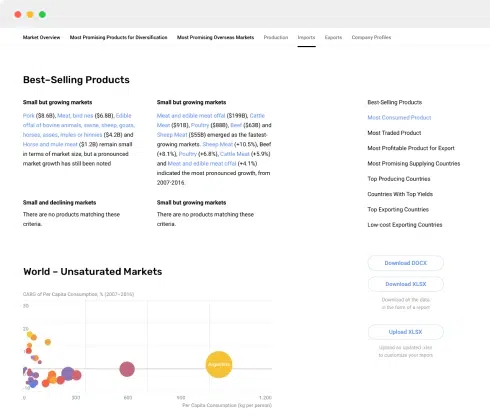

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

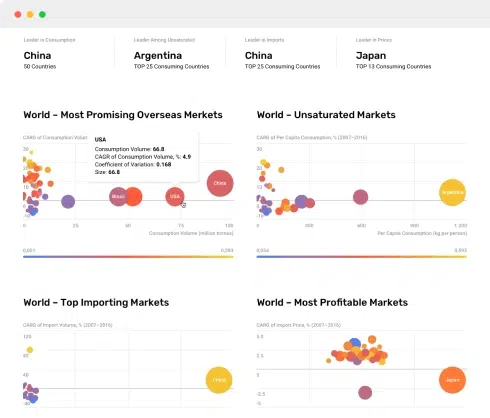

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. GLOBAL PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

8. GLOBAL IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. GLOBAL EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- United States

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

-

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023

This report provides an in-depth analysis of the global market for crude oil and processed petroleum.

This report provides an in-depth analysis of the global crude oil market.