Metals; Palladium, Semi-Manufactured Price in Poland - 2023

Contents:

- Metals; Palladium, Semi-Manufactured Price in Poland (FOB) - 2023

- Metals; Palladium, Semi-Manufactured Price in Poland (CIF) - 2022

- Metals; Palladium, Semi-Manufactured Exports in Poland

- Metals; Palladium, Semi-Manufactured Imports in Poland

Metals; Palladium, Semi-Manufactured Price in Poland (FOB) - 2023

The average metals; palladium, semi-manufactured export price stood at $53.8M per ton in April 2023, surging by 21% against the previous month. Overall, the export price, however, saw a pronounced shrinkage. The most prominent rate of growth was recorded in October 2022 an increase of 81% m-o-m. Over the period under review, the average export prices attained the maximum at $72.8M per ton in January 2023; afterwards, it flattened through to April 2023.

As there is only one major export destination, the average price level is determined by prices for Germany.

From May 2022 to April 2023, the rate of growth in terms of prices for Italy amounted to +2.8% per month.

Metals; Palladium, Semi-Manufactured Price in Poland (CIF) - 2022

The average metals; palladium, semi-manufactured import price stood at $9,955,502 per ton in 2022, shrinking by -19.8% against the previous year. Overall, the import price recorded a abrupt downturn. The growth pace was the most rapid in 2014 an increase of 34% against the previous year. Over the period under review, average import prices reached the maximum at $33,563,155 per ton in 2018; however, from 2019 to 2022, import prices stood at a somewhat lower figure.

There were significant differences in the average prices amongst the major supplying countries. In 2022, amid the top importers, the country with the highest price was Germany ($13,579,933 per ton), while the price for the UK ($2,413,077 per ton) was amongst the lowest.

From 2012 to 2022, the most notable rate of growth in terms of prices was attained by the United States (-1.4%), while the prices for the other major suppliers experienced a decline.

Metals; Palladium, Semi-Manufactured Exports in Poland

In 2022, overseas shipments of metals; palladium, semi-manufactureds decreased by -89.2% to 135 kg for the first time since 2018, thus ending a three-year rising trend. Overall, exports continue to indicate a significant contraction. The growth pace was the most rapid in 2021 with an increase of 112% against the previous year. As a result, the exports reached the peak of 1.2 tons, and then fell remarkably in the following year.

In value terms, metals; palladium, semi-manufactured exports dropped significantly to $9.1M in 2022. Over the period under review, exports showed a abrupt downturn. The pace of growth appeared the most rapid in 2020 when exports increased by 53% against the previous year.

| Export of Metals; Palladium, Semi-Manufactured in Poland (Million USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| Germany | 7.8 | 6.7 | 15.2 | 7.8 | 0.0% |

| Italy | 5.9 | 15.0 | 15.1 | 1.3 | -39.6% |

| Others | 0.5 | N/A | N/A | N/A | 0% |

| Total | 14.3 | 21.8 | 30.3 | 9.1 | -14.0% |

Top Export Markets for Metals; Palladium, Semi-Manufactured from Poland in 2022:

- Germany (77.0 kg)

- Italy (58.0 kg)

Metals; Palladium, Semi-Manufactured Imports in Poland

In 2022, the amount of metals; palladium, semi-manufactureds imported into Poland fell to 36 kg, declining by -7.7% compared with 2021 figures. Over the period under review, imports recorded a dramatic downturn.

In value terms, metals; palladium, semi-manufactured imports contracted remarkably to $362K in 2022. Overall, imports continue to indicate a dramatic slump.

| Import of Metals; Palladium, Semi-Manufactured in Poland (Thousand USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| Germany | 373 | 404 | 437 | 247 | -12.8% |

| United States | 22.4 | 53.1 | 37.3 | 115 | 72.5% |

| Russia | N/A | 401 | N/A | N/A | 0% |

| Ireland | 2,423 | 612 | N/A | N/A | -74.7% |

| France | 39.3 | N/A | N/A | N/A | 0% |

| Others | 51.6 | 29.7 | 15.2 | 0.6 | -77.3% |

| Total | 2,909 | 1,500 | 489 | 362 | -50.1% |

Top Suppliers of Metals; Palladium, Semi-Manufactured to Poland in 2022:

- United States (18.0 kg)

- Germany (18.0 kg)

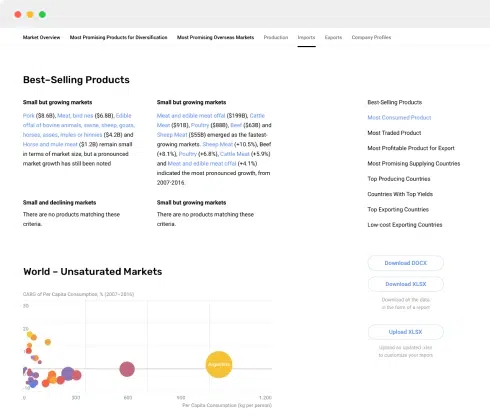

This report provides an in-depth analysis of the platinum market in Poland.

This report provides an in-depth analysis of the global platinum market.

This report provides an in-depth analysis of the platinum market in Poland.

This report provides an in-depth analysis of the global platinum market.

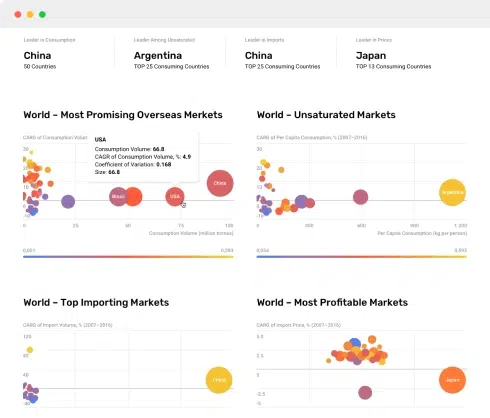

Explore the top import markets for platinum, with key statistics and insights. China, the United States, and the United Kingdom lead the pack in platinum imports. Find out more.

In 2016, approx. X tons of platinum were imported worldwide- jumping by X% against the previous year figure. Overall, it indicated a notable increase from 2007 to 2016: the total imports volume i...

In 2016, approx. X tons of platinum were imported worldwide- jumping by X% against the previous year figure. Overall, it indicated a notable increase from 2007 to 2016: the total imports volume i...

In 2014, the U.S. (X%), Switzerland (X%), the United Kingdom (X%) and Germany (X%) were the main suppliers of platinum into Italy, together making up X% of their total imports. Between 2007 and 2014, Austria had the highest growth rates in

Explore the top import markets for platinum, with key statistics and insights. China, the United States, and the United Kingdom lead the pack in platinum imports. Find out more.

In 2016, approx. X tons of platinum were imported worldwide- jumping by X% against the previous year figure. Overall, it indicated a notable increase from 2007 to 2016: the total imports volume i...

In 2016, approx. X tons of platinum were imported worldwide- jumping by X% against the previous year figure. Overall, it indicated a notable increase from 2007 to 2016: the total imports volume i...

In 2014, the U.S. (X%), Switzerland (X%), the United Kingdom (X%) and Germany (X%) were the main suppliers of platinum into Italy, together making up X% of their total imports. Between 2007 and 2014, Austria had the highest growth rates in