Price for Cereals; Millet, Other than Seed in Japan - 2023

Contents:

- Price for Cereals; Millet, Other than Seed in Japan (CIF) - 2023

- Price for Cereals; Millet, Other than Seed in Japan (FOB) - 2022

- Imports of Cereals; Millet, Other than Seed in Japan

- Exports of Cereals; Millet, Other than Seed in Japan

Price for Cereals; Millet, Other than Seed in Japan (CIF) - 2023

In November 2023, the average import price for cereals; millet, other than seeds amounted to $640 per ton, with a decrease of -8.5% against the previous month. Overall, the import price saw a relatively flat trend pattern. The pace of growth appeared the most rapid in January 2023 when the average import price increased by 24% against the previous month. Over the period under review, average import prices reached the peak figure at $712 per ton in February 2023; however, from March 2023 to November 2023, import prices stood at a somewhat lower figure.

There were significant differences in the average prices amongst the major supplying countries. In November 2023, the country with the highest price was China ($820 per ton), while the price for the United States ($540 per ton) was amongst the lowest.

From November 2022 to November 2023, the most notable rate of growth in terms of prices was attained by Poland (+3.5%), while the prices for the other major suppliers experienced more modest paces of growth.

Price for Cereals; Millet, Other than Seed in Japan (FOB) - 2022

The average export price for cereals; millet, other than seeds stood at $5,235 per ton in 2022, approximately mirroring the previous year. Overall, the export price enjoyed a buoyant expansion. The most prominent rate of growth was recorded in 2019 when the average export price increased by 278%. The export price peaked at $5,777 per ton in 2020; however, from 2021 to 2022, the export prices stood at a somewhat lower figure.

Prices varied noticeably by country of destination: amid the top suppliers, the country with the highest price was Hong Kong SAR ($5,950 per ton), while the average price for exports to the UK ($722 per ton) was amongst the lowest.

From 2012 to 2022, the most notable rate of growth in terms of prices was recorded for supplies to Hong Kong SAR (+14.8%), while the prices for the other major destinations experienced mixed trend patterns.

Imports of Cereals; Millet, Other than Seed in Japan

In 2022, after three years of growth, there was significant decline in overseas purchases of cereals; millet, other than seeds, when their volume decreased by -8.3% to 9.1K tons. The total import volume increased at an average annual rate of +3.0% over the period from 2019 to 2022; the trend pattern remained relatively stable, with somewhat noticeable fluctuations being recorded in certain years. The most prominent rate of growth was recorded in 2021 with an increase of 9.6%. As a result, imports attained the peak of 10K tons, and then contracted in the following year.

In value terms, cereals; millet, other than seed imports declined modestly to $5.7M in 2022. The total import value increased at an average annual rate of +6.8% over the period from 2019 to 2022; the trend pattern remained relatively stable, with only minor fluctuations being observed throughout the analyzed period. The pace of growth appeared the most rapid in 2020 when imports increased by 14% against the previous year.

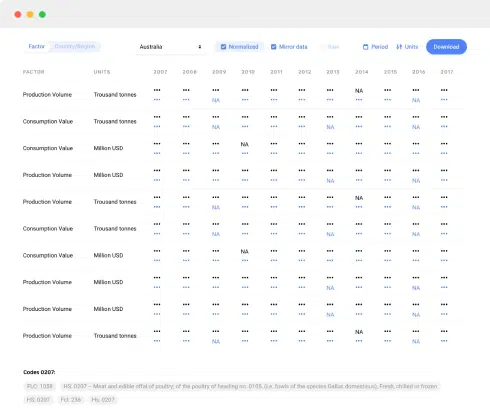

| Import of Cereals; Millet, Other than Seed in Japan (Thousand USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| India | 1,543 | 2,129 | 2,314 | 2,866 | 22.9% |

| China | 1,276 | 1,128 | 1,210 | 1,084 | -5.3% |

| United States | 1,411 | 995 | 356 | 634 | -23.4% |

| Russia | 45.0 | 293 | 692 | 552 | 130.6% |

| Australia | 106 | 470 | 360 | 260 | 34.9% |

| Ukraine | 110 | 89.8 | 716 | 211 | 24.3% |

| Others | 196 | 255 | 242 | 110 | -17.5% |

| Total | 4,687 | 5,359 | 5,889 | 5,717 | 6.8% |

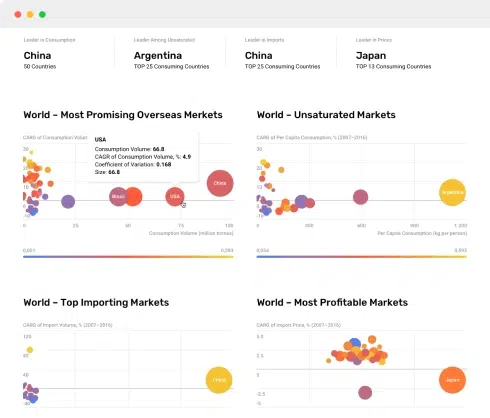

Top Suppliers of Cereals; Millet, Other than Seed to Japan in 2022:

- India (5.2K tons)

- Russia (1.2K tons)

- United States (0.9K tons)

- China (0.9K tons)

- Ukraine (0.5K tons)

- Australia (0.3K tons)

Exports of Cereals; Millet, Other than Seed in Japan

Cereals; millet, other than seed exports from Japan reached 24 tons in 2022, with an increase of 7% against the previous year. Overall, exports, however, showed a abrupt setback. The most prominent rate of growth was recorded in 2021 with an increase of 34%.

In value terms, cereals; millet, other than seed exports rose significantly to $125K in 2022. The total export value increased at an average annual rate of +6.1% over the period from 2019 to 2022; however, the trend pattern indicated some noticeable fluctuations being recorded in certain years. The growth pace was the most rapid in 2021 with an increase of 22%. The exports peaked in 2022 and are likely to see steady growth in years to come.

| Export of Cereals; Millet, Other than Seed in Japan (Thousand USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| Hong Kong SAR | 98.3 | 91.1 | 110 | 119 | 6.6% |

| South Africa | N/A | N/A | N/A | 1.6 | 0% |

| United Kingdom | N/A | N/A | N/A | 1.2 | 0% |

| France | 2.6 | 1.3 | 0.9 | 0.6 | -38.7% |

| Others | 3.5 | 3.3 | 4.9 | 2.7 | -8.3% |

| Total | 104 | 95.6 | 116 | 125 | 6.3% |

Top Export Markets for Cereals; Millet, Other than Seed from Japan in 2022:

- Hong Kong SAR (19.9 tons)

- United Kingdom (1.6 tons)

- South Africa (1.5 tons)

- France (0.5 tons)

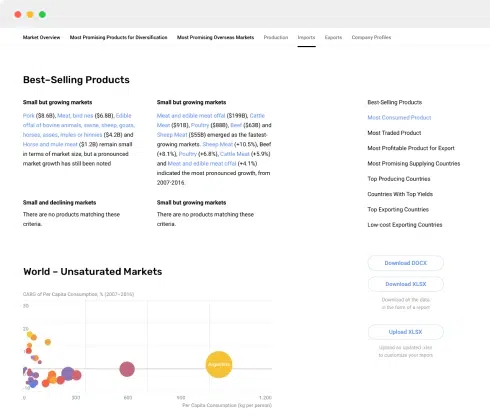

This report provides an in-depth analysis of the millet market in Japan.

This report provides an in-depth analysis of the buckwheat market in Japan.

This report provides an in-depth analysis of the canary seed market in Japan.

This report provides an in-depth analysis of the fonio market in Japan.

This report provides an in-depth analysis of the quinoa market in Japan.

This report provides an in-depth analysis of the triticale market in Japan.

This report provides an in-depth analysis of the cereal market in Japan.

This report provides an in-depth analysis of the grain market in Japan.

This report provides an in-depth analysis of the grain market in Japan.

This report provides an in-depth analysis of the global millet market.

Overall, imports of Buckwheat remained stable, with a noteworthy increase in value to $2.5M in November 2023.

In April 2023, the buckwheat price stood at $970 per ton (CIF, Japan), falling by -3% against the previous month.

Global millet consumption amounted to X thousand tons in 2015, lowering by -X% against the previous year level.

In 2015, the country with the largest volume of the millet output was India (X thousand tons), accounting for X% of global production.

The U.S. continues its dominance in the global millet trade. In 2014, the U.S. exported X thousand tons of millet totaling X million USD, X% over the previous year. Its primary trading partner was Canada, where it supplied X% of its total millet

In the immediate term, the global buckwheat market may face a shortage due to an export ban introduced in Russia. The country, being the largest producer and exporter of buckwheat, restricted exporting unprocessed buckwheat, coarsely ground buckwheat groats, and crushed buckwheat grain from June 5, 2021, to August 31. Russia took this step to preserve the volumes of the buckwheat grain for its domestic consumption and prevent a spike in prices inside the country. China, Latvia and Ukraine featured the most prominent increases in imports from Russia in 2021.

Global buckwheat consumption amounted to X thousand tons in 2015, surging by +X% against the previous year level.

Global buckwheat exports amounted to X thousand tons in 2015, moving up by +X% against the previous year level.

Global buckwheat imports amounted to X thousand tons in 2015, going up by +X% against the previous year level.

In 2015, the countries with the highest levels of production in 2015 were Russia (X thousand tons), China (X thousand tons), France (X thousand tons), together accounting for X% of total output.