Price for Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated in Turkey - 2023

Contents:

- Price for Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated in Turkey (CIF) - 2023

- Price for Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated in Turkey (FOB) - 2022

- Imports of Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated in Turkey

- Exports of Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated in Turkey

Price for Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated in Turkey (CIF) - 2023

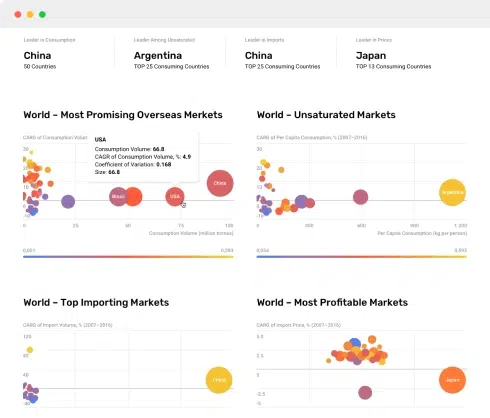

In December 2023, the average import price for coal; anthracite, whether or not pulverised, but not agglomerateds amounted to $154 per ton, dropping by -27.4% against the previous month. Over the period under review, the import price continues to indicate a noticeable reduction. The most prominent rate of growth was recorded in November 2023 an increase of 53% month-to-month. Over the period under review, average import prices attained the peak figure at $268 per ton in December 2022; however, from January 2023 to December 2023, import prices failed to regain momentum.

Average prices varied noticeably amongst the major supplying countries. In December 2023, the country with the highest price was Kazakhstan ($157 per ton), while the price for Tajikistan ($131 per ton) was amongst the lowest.

From December 2022 to December 2023, the most notable rate of growth in terms of prices was attained by China (0.0%), while the prices for the other major suppliers experienced a decline.

Price for Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated in Turkey (FOB) - 2022

The average export price for coal; anthracite, whether or not pulverised, but not agglomerateds stood at $327 per ton in 2022, growing by 53% against the previous year. In general, the export price recorded a slight increase. As a result, the export price reached the peak level and is likely to continue growth in the immediate term.

There were significant differences in the average prices for the major external markets. In 2022, amid the top suppliers, the country with the highest price was Albania ($853 per ton), while the average price for exports to Morocco ($275 per ton) was amongst the lowest.

From 2012 to 2022, the most notable rate of growth in terms of prices was recorded for supplies to Algeria (+25.7%), while the prices for the other major destinations experienced more modest paces of growth.

Imports of Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated in Turkey

In 2022, imports of coal; anthracite, whether or not pulverised, but not agglomerateds into Turkey soared to 2.2M tons, picking up by 165% against 2021 figures. In general, imports saw significant growth. As a result, imports reached the peak and are likely to continue growth in the immediate term.

In value terms, imports of coal; anthracite, whether or not pulverised, but not agglomerateds skyrocketed to $270M in 2022. Over the period under review, imports enjoyed a significant expansion. As a result, imports attained the peak and are likely to continue growth in the immediate term.

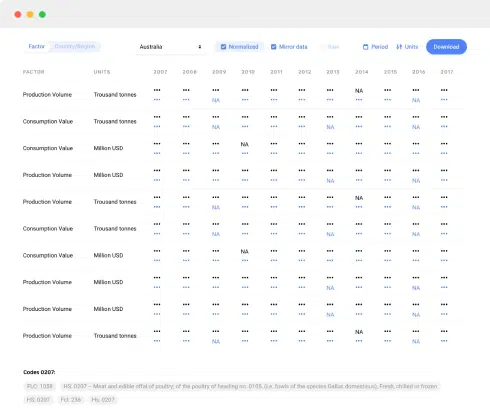

| Import of Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated in Turkey (Million USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| Russia | 98.5 | 87.8 | 98.2 | 254 | 37.1% |

| Others | 6.7 | 0.2 | 0.8 | 16.0 | 33.7% |

| Total | 105 | 87.9 | 99.1 | 270 | 37.0% |

Top Suppliers of Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated to Turkey in 2022:

- Russia (2.1M tons)

Exports of Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated in Turkey

In 2022, exports of coal; anthracite, whether or not pulverised, but not agglomerateds from Turkey skyrocketed to 59K tons, picking up by 286% compared with the previous year. Overall, exports recorded significant growth. As a result, the exports reached the peak and are likely to continue growth in the immediate term.

In value terms, exports of coal; anthracite, whether or not pulverised, but not agglomerateds soared to $19M in 2022. In general, exports saw significant growth. As a result, the exports attained the peak and are likely to continue growth in the immediate term.

| Export of Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated in Turkey (Million USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| Oman | N/A | N/A | N/A | 4.5 | 0% |

| United Arab Emirates | N/A | N/A | N/A | 4.0 | 0% |

| Iraq | 1.4 | 0.9 | 2.4 | 2.8 | 26.0% |

| Bahrain | N/A | N/A | N/A | 1.9 | 0% |

| Saudi Arabia | N/A | N/A | N/A | 1.8 | 0% |

| Israel | N/A | N/A | 0.1 | 0.7 | 600.0% |

| Morocco | N/A | N/A | N/A | 0.6 | 0% |

| Jordan | N/A | N/A | N/A | 0.6 | 0% |

| Algeria | N/A | N/A | 0.5 | 0.5 | 0.0% |

| Pakistan | N/A | N/A | N/A | 0.4 | 0% |

| Others | 0.4 | 0.3 | 0.3 | 1.3 | 48.1% |

| Total | 1.8 | 1.2 | 3.2 | 19.2 | 120.1% |

Top Export Markets for Coal; Anthracite, Whether or Not Pulverised, But Not Agglomerated from Turkey in 2022:

- Oman (15.3K tons)

- United Arab Emirates (9.6K tons)

- Iraq (8.8K tons)

- Bahrain (6.7K tons)

- Saudi Arabia (5.9K tons)

- Morocco (2.4K tons)

- Israel (1.9K tons)

- Jordan (1.8K tons)

- Algeria (1.7K tons)

- Pakistan (1.2K tons)

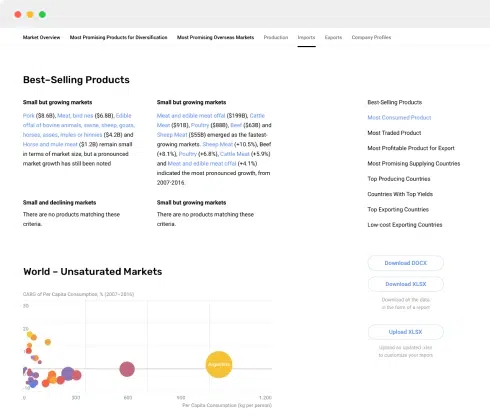

This report provides an in-depth analysis of the market for coal other than lignite in Turkey.

This report provides an in-depth analysis of the coal market in Turkey.

This report provides an in-depth analysis of the global market for coal other than lignite.

This report provides an in-depth analysis of the global coal market.

This report provides an in-depth analysis of the market for coal other than lignite in Turkey.

This report provides an in-depth analysis of the coal market in Turkey.

This report provides an in-depth analysis of the global market for coal other than lignite.

This report provides an in-depth analysis of the global coal market.

In December 2022, the coal price stood at $200 per ton (CIF, Turkey), picking up by 5.7% against the previous month. The most prominent rate of growth was recorded in August 2022 when the average import price increased by 44% month-to-month. From January 2022 to December 2022, the rate of growth in terms of prices for coal other than lingite amounted to +1.4% per month. In value terms, coal imports fell to $587M (IndexBox estimates) in December 2022. In December 2022, Russia constituted the largest supplier of coal to Turkey.

Explore the top import markets for high-quality coal other than lignite with key statistics and data from the IndexBox market intelligence platform.

This article provides a list of the top importers of coal in 2022, including Japan, India, China, South Korea, Germany, Turkey, Malaysia, Netherlands, Philippines, and Brazil. These countries heavily rely on coal as a source of energy for electricity generation and industrial processes. However, as the world moves towards cleaner energy sources, the future of coal imports is uncertain.

In 2020, the decline in the global coal market gathered momentum, against the Covid-19 pandemic. The low cost of natural gas, combined with the development of alternative energy sources and stricter environmental regulations, are pushing the coal energy sector into stagnation. In the medium term, only the metallurgical industry is set to see a stable demand for coal.

The global coal trade amounted to X million USD in 2015, fluctuating mildly over the period under review, with a consistent downward trend in the last four years. A slight drop in 2009 was followed by brief recovery over the next two years, until

In December 2022, the coal price stood at $200 per ton (CIF, Turkey), picking up by 5.7% against the previous month. The most prominent rate of growth was recorded in August 2022 when the average import price increased by 44% month-to-month. From January 2022 to December 2022, the rate of growth in terms of prices for coal other than lingite amounted to +1.4% per month. In value terms, coal imports fell to $587M (IndexBox estimates) in December 2022. In December 2022, Russia constituted the largest supplier of coal to Turkey.

Explore the top import markets for high-quality coal other than lignite with key statistics and data from the IndexBox market intelligence platform.

This article provides a list of the top importers of coal in 2022, including Japan, India, China, South Korea, Germany, Turkey, Malaysia, Netherlands, Philippines, and Brazil. These countries heavily rely on coal as a source of energy for electricity generation and industrial processes. However, as the world moves towards cleaner energy sources, the future of coal imports is uncertain.

In 2020, the decline in the global coal market gathered momentum, against the Covid-19 pandemic. The low cost of natural gas, combined with the development of alternative energy sources and stricter environmental regulations, are pushing the coal energy sector into stagnation. In the medium term, only the metallurgical industry is set to see a stable demand for coal.

The global coal trade amounted to X million USD in 2015, fluctuating mildly over the period under review, with a consistent downward trend in the last four years. A slight drop in 2009 was followed by brief recovery over the next two years, until