Price for Fresh or Chilled Domestic Ducks, Not Cut in Pieces in Vietnam - 2022

Contents:

- Price for Fresh or Chilled Domestic Ducks, Not Cut in Pieces in Vietnam (CIF) - 2022

- Price for Fresh or Chilled Domestic Ducks, Not Cut in Pieces in Vietnam (FOB) - 2022

- Imports of Fresh or Chilled Domestic Ducks, Not Cut in Pieces in Vietnam

- Exports of Fresh or Chilled Domestic Ducks, Not Cut in Pieces in Vietnam

Price for Fresh or Chilled Domestic Ducks, Not Cut in Pieces in Vietnam (CIF) - 2022

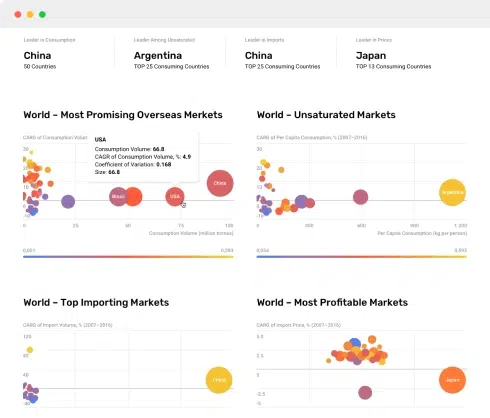

The average import price for fresh or chilled domestic ducks, not cut in pieceses stood at $23,464 per ton in 2022, rising by 50% against the previous year. Over the period under review, the import price enjoyed a prominent expansion. The most prominent rate of growth was recorded in 2021 an increase of 50%. Over the period under review, average import prices attained the peak figure in 2022 and is likely to see gradual growth in the immediate term.

As there is only one major supplying country, the average price level is determined by prices for France.

From 2012 to 2022, the rate of growth in terms of prices for France amounted to +19.4% per year.

Price for Fresh or Chilled Domestic Ducks, Not Cut in Pieces in Vietnam (FOB) - 2022

In 2022, the average export price for fresh or chilled domestic ducks, not cut in pieceses amounted to $2,698 per ton, approximately mirroring the previous year. In general, export price indicated a resilient increase from 2012 to 2022: its price increased at an average annual rate of +6.8% over the last decade. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. The most prominent rate of growth was recorded in 2013 an increase of 165% against the previous year. As a result, the export price reached the peak level of $3,695 per ton. From 2014 to 2022, the average export prices failed to regain momentum.

As there is only one major export destination, the average price level is determined by prices for Panama.

From 2012 to 2022, the rate of growth in terms of prices for Panama amounted to +0.7% per year.

Imports of Fresh or Chilled Domestic Ducks, Not Cut in Pieces in Vietnam

For the third year in a row, Vietnam recorded decline in overseas purchases of fresh or chilled domestic ducks, not cut in pieceses, which decreased by -20% to 420 kg in 2022. Over the period under review, imports faced a dramatic descent. The smallest decline of -20% was in 2020.

In value terms, imports of fresh or chilled domestic ducks, not cut in pieceses surged to $9.9K in 2022. Overall, total imports indicated a significant expansion from 2019 to 2022: its value increased at an average annual rate of +20.0% over the last three years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2022 figures, imports increased by +72.8% against 2019 indices. The most prominent rate of growth was recorded in 2020 with an increase of 20% against the previous year. Over the period under review, imports of reached the maximum in 2022 and are likely to continue growth in the near future.

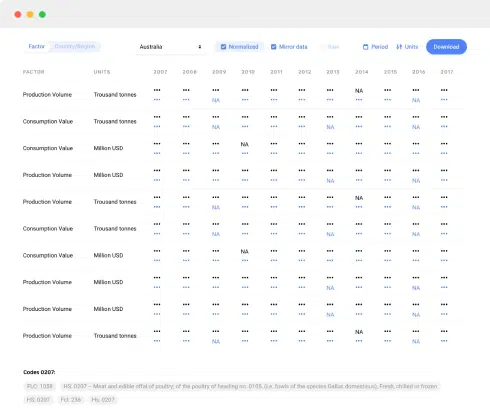

| Import of Fresh or Chilled Domestic Ducks, Not Cut in Pieces in Vietnam (Thousand USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| France | 5.7 | 6.8 | 8.2 | 7.5 | 9.6% |

| Others | N/A | N/A | N/A | 2.3 | 0% |

| Total | 5.7 | 6.8 | 8.2 | 9.9 | 20.2% |

Top Suppliers of Fresh or Chilled Domestic Ducks, Not Cut in Pieces to Vietnam in 2022:

- France (591.0 kg)

Exports of Fresh or Chilled Domestic Ducks, Not Cut in Pieces in Vietnam

In 2022, shipments abroad of fresh or chilled domestic ducks, not cut in pieceses was finally on the rise to reach 506 kg for the first time since 2019, thus ending a two-year declining trend. Overall, exports, however, continue to indicate a deep setback.

In value terms, exports of fresh or chilled domestic ducks, not cut in pieceses skyrocketed to $1.4K in 2022. Over the period under review, exports, however, recorded a abrupt downturn.

| Export of Fresh or Chilled Domestic Ducks, Not Cut in Pieces in Vietnam (USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| Panama | 2,137 | 1,381 | 15.0 | 978 | -22.9% |

| Hong Kong SAR | N/A | N/A | 36.0 | N/A | 0% |

| Austria | N/A | N/A | 525 | N/A | 0% |

| Others | N/A | N/A | N/A | 387 | 0% |

| Total | 2,137 | 1,381 | 576 | 1,365 | -13.9% |

Top Export Markets for Fresh or Chilled Domestic Ducks, Not Cut in Pieces from Vietnam in 2022:

- Panama (364.0 kg)

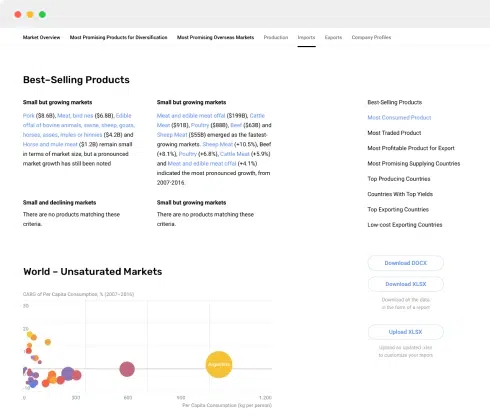

This report provides an in-depth analysis of the market for fresh or chilled whole geese, ducks and guinea fowls in Vietnam.

This report provides an in-depth analysis of the market for fresh or chilled or frozen whole geese, ducks and guinea fowls in Vietnam.

This report provides an in-depth analysis of the frozen whole chicken market in Vietnam.

This report provides an in-depth analysis of the frozen turkey cut market in Vietnam.

This report provides an in-depth analysis of the market for frozen whole geese, ducks and guinea fowls in Vietnam.

This report provides an in-depth analysis of the frozen whole turkey market in Vietnam.

This report provides an in-depth analysis of the frozen poultry liver market in Vietnam.

This report provides an in-depth analysis of the duck meat market in Vietnam.

This report provides an in-depth analysis of the market for frozen cuts of ducks, geese and guinea fowls in Vietnam.

This report provides an in-depth analysis of the frozen chicken cut market in Vietnam.

In 2015, the country with the largest volume of the duck meat output was China (X thousand tons), accounting for X% of global production. The third position in this ranking was occupied by Hungary with a share of X>

The Netherlands dominates in the global trade of duck, goose and guinea fowl. In 2014, the Netherlands exported X million units of duck, goose and guinea fowl totaling X million USD, X% over the previous year. Its primary trading partner was Germany,

Discover the top import markets for frozen chicken cut worldwide, including China, Japan, the Netherlands, UAE, Philippines, Ghana, Saudi Arabia, South Korea, France, and Germany. Explore key statistics and market trends driving the demand for this popular poultry product. Stay informed with IndexBox market intelligence to seize potential opportunities.

Explore the top 10 import markets for fresh chicken cut based on import value data provided by the IndexBox market intelligence platform. Find out which countries are leading the way in importing this popular poultry product.

Chicken meat is one of the most widely consumed and versatile meats in the world. This article explores the top import markets for chicken meat based on import value data. China leads as the largest importer, followed by the United Kingdom, France, Germany, Japan, the Netherlands, Saudi Arabia, the United Arab Emirates, Mexico, and Hong Kong SAR. These markets are driven by factors such as changing consumption patterns, increasing population, growing tourism, and thriving foodservice industries.

Discover the top import markets for poultry, including China, Germany, the United Kingdom, France, and Japan. These countries heavily rely on imports to meet the growing demand for poultry products. Exporters can capitalize on these markets by tailoring their offerings to meet specific preferences and requirements. With market intelligence from platforms like IndexBox, businesses can gain valuable insights and seize the opportunities presented by these import markets.

The global chicken meat market is projected to reach $262 billion by 2030, growing at a CAGR of 3.4%.

In December 2021, the chicken price peaked at $2.74 per kg, gaining 17% from a month earlier. The average annual figure is forecast to rise from $2.26 per kg last year to $2.30 per kg in 2022.

Since the start of 2021, prices in the global chicken meat market shot up as a result of high demand, rising costs for feed grain and food as well as a decreasing rate of chicken slaughter in the EU, South Korea and Japan. Heightened costs for shipping containers are additionally driving the growth in export prices. As of year-end 2021, worldwide production and exports of chicken meat are forecast to remain at the previous year’s level. Demand for chicken meat in China is dropping while the pig population in the country is recovering and hog prices are decreasing. Saudi Arabia’s ban on imports of chicken products from Brazil may lead to diminished exports from that country.

In 2020, global duck and goose meat imports increased by +3.3% y-o-y to 268K tons and reached $1.1B in value terms. Germany and Hong Kong constitute the largest importers of these products worldwide. In 2020, Spain, Denmark, Belgium and the Netherlands saw the highest spikes in imports in physical terms. Over the last year, the average duck and goose meat import price rose by +6.5% y-o-y. Hungary, China, Poland and France are the key suppliers worldwide, with a combined 66%-share of the global export volume.