Price for Metals; Rhodium, Unwrought or in Powder Form in Poland - 2023

Contents:

- Price for Metals; Rhodium, Unwrought or in Powder Form in Poland (CIF) - 2023

- Price for Metals; Rhodium, Unwrought or in Powder Form in Poland (FOB) - 2023

- Imports of Metals; Rhodium, Unwrought or in Powder Form in Poland

- Exports of Metals; Rhodium, Unwrought or in Powder Form in Poland

Price for Metals; Rhodium, Unwrought or in Powder Form in Poland (CIF) - 2023

The average import price for metals; rhodium, unwrought or in powder forms stood at $154M per ton in December 2023, with an increase of 5.3% against the previous month. Over the period under review, the import price, however, continues to indicate a deep contraction. The most prominent rate of growth was recorded in October 2023 when the average import price increased by 13% month-to-month. Over the period under review, average import prices hit record highs at $411M per ton in December 2022; however, from January 2023 to December 2023, import prices failed to regain momentum.

As there is only one major supplying country, the average price level is determined by prices for Italy.

From December 2022 to December 2023, the rate of growth in terms of prices for Italy amounted to -7.9% per month.

Price for Metals; Rhodium, Unwrought or in Powder Form in Poland (FOB) - 2023

The average export price for metals; rhodium, unwrought or in powder forms stood at $197M per ton in October 2023, growing by 30% against the previous month. Over the period under review, the export price, however, recorded a abrupt setback. The export price peaked at $421M per ton in February 2023; however, from March 2023 to October 2023, the export prices failed to regain momentum.

As there is only one major export destination, the average price level is determined by prices for Germany.

From February 2023 to October 2023, the rate of growth in terms of prices for Germany amounted to -10.1% per month.

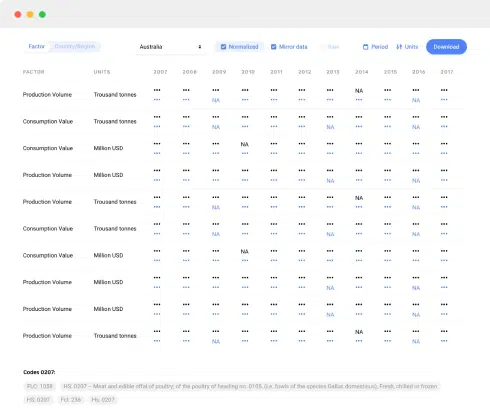

Imports of Metals; Rhodium, Unwrought or in Powder Form in Poland

In 2022, supplies from abroad of metals; rhodium, unwrought or in powder forms decreased by -27.9% to 2.2 tons for the first time since 2018, thus ending a three-year rising trend. Over the period under review, imports, however, posted a significant increase. The most prominent rate of growth was recorded in 2021 when imports increased by 70%. As a result, imports attained the peak of 3.1 tons, and then contracted remarkably in the following year.

In value terms, imports of metals; rhodium, unwrought or in powder forms reduced remarkably to $387M in 2022. Overall, imports, however, enjoyed a significant expansion. The pace of growth was the most pronounced in 2021 when imports increased by 99%. As a result, imports attained the peak of $458M, and then contracted markedly in the following year.

| Import of Metals; Rhodium, Unwrought or in Powder Form in Poland (Million USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| Italy | 62.3 | 230 | 458 | 386 | 83.7% |

| Others | 70.4 | 1.2 | N/A | 1.6 | -71.7% |

| Total | 133 | 231 | 458 | 387 | 42.8% |

Top Suppliers of Metals; Rhodium, Unwrought or in Powder Form to Poland in 2022:

- Italy (2.2 tons)

Exports of Metals; Rhodium, Unwrought or in Powder Form in Poland

For the third year in a row, Poland recorded decline in overseas shipments of metals; rhodium, unwrought or in powder forms, which decreased by -33.3% to 6 kg in 2022. In general, exports showed a sharp downturn. The smallest decline of -10% was in 2021.

In value terms, exports of metals; rhodium, unwrought or in powder forms declined notably to $2.3M in 2022. Overall, exports showed a dramatic setback. The most prominent rate of growth was recorded in 2021 with an increase of 67% against the previous year.

| Export of Metals; Rhodium, Unwrought or in Powder Form in Poland (Million USD) | |||||

|---|---|---|---|---|---|

| COUNTRY | 2019 | 2020 | 2021 | 2022 | CAGR, 2019-2022 |

| Germany | 0.4 | 2.6 | 5.7 | 2.3 | 79.2% |

| Czech Republic | 4.6 | 0.8 | N/A | N/A | -82.6% |

| Italy | 0.1 | N/A | N/A | N/A | 0% |

| Others | 5.1 | N/A | N/A | N/A | 0% |

| Total | 10.1 | 3.4 | 5.7 | 2.3 | -38.9% |

Top Export Markets for Metals; Rhodium, Unwrought or in Powder Form from Poland in 2022:

- Germany (5.0 kg)

- Czech Republic (1.0 kg)

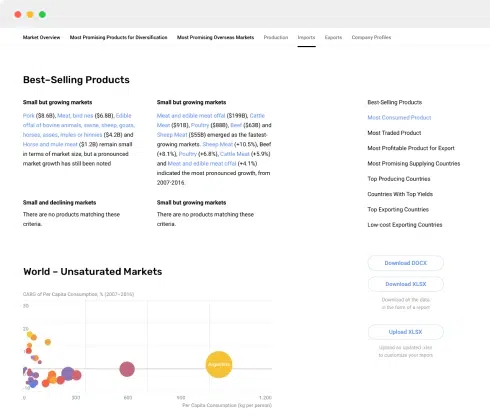

This report provides an in-depth analysis of the platinum market in Poland.

This report provides an in-depth analysis of the global platinum market.

This report provides an in-depth analysis of the platinum market in Poland.

This report provides an in-depth analysis of the global platinum market.

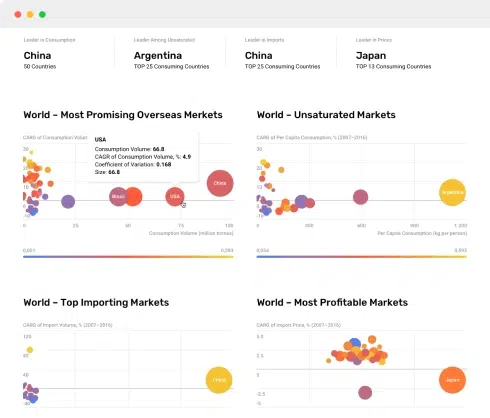

Explore the top import markets for platinum, with key statistics and insights. China, the United States, and the United Kingdom lead the pack in platinum imports. Find out more.

In 2016, approx. X tons of platinum were imported worldwide- jumping by X% against the previous year figure. Overall, it indicated a notable increase from 2007 to 2016: the total imports volume i...

In 2016, approx. X tons of platinum were imported worldwide- jumping by X% against the previous year figure. Overall, it indicated a notable increase from 2007 to 2016: the total imports volume i...

In 2014, the U.S. (X%), Switzerland (X%), the United Kingdom (X%) and Germany (X%) were the main suppliers of platinum into Italy, together making up X% of their total imports. Between 2007 and 2014, Austria had the highest growth rates in

Explore the top import markets for platinum, with key statistics and insights. China, the United States, and the United Kingdom lead the pack in platinum imports. Find out more.

In 2016, approx. X tons of platinum were imported worldwide- jumping by X% against the previous year figure. Overall, it indicated a notable increase from 2007 to 2016: the total imports volume i...

In 2016, approx. X tons of platinum were imported worldwide- jumping by X% against the previous year figure. Overall, it indicated a notable increase from 2007 to 2016: the total imports volume i...

In 2014, the U.S. (X%), Switzerland (X%), the United Kingdom (X%) and Germany (X%) were the main suppliers of platinum into Italy, together making up X% of their total imports. Between 2007 and 2014, Austria had the highest growth rates in